Edd Overpayment Forgiveness: Your Ultimate Guide To Understanding And Claiming It

Apr 10 2025

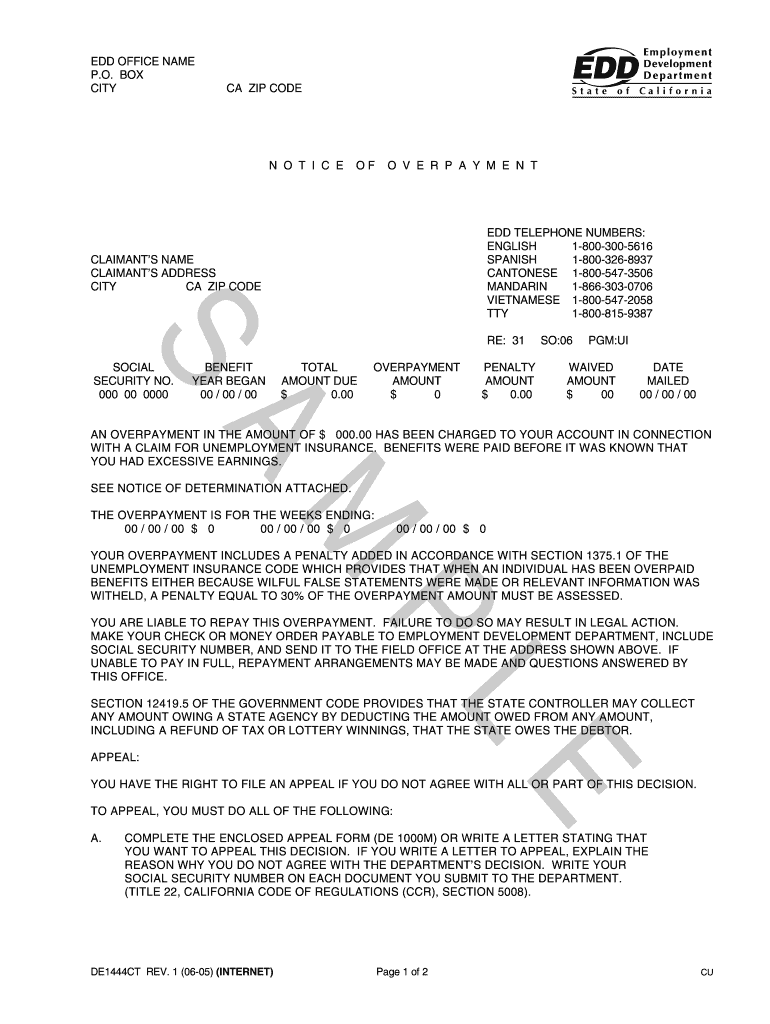

Let me tell you something, folks. If you’ve ever found yourself stressing over an EDD overpayment, you’re not alone. Many people have faced this exact situation, and let me assure you, there’s hope. The EDD overpayment forgiveness program is here to help you out of that financial pickle. Now, before we dive deep into the nitty-gritty, let’s break it down for you in plain English so you know exactly what you’re dealing with.

Imagine this: you’ve been receiving unemployment benefits because life happened, and then suddenly, the EDD informs you that you’ve been overpaid. Yikes, right? But hold up. The EDD understands that mistakes happen, and they’ve got a system in place to forgive some or all of that overpayment. It’s like a lifeline when you least expect it.

So, why should you care about this? Because if you’ve been hit with an EDD overpayment, you need to know your options. Understanding the forgiveness process can save you a lot of headache and even money. Stick around, and we’ll walk you through everything you need to know about EDD overpayment forgiveness, step by step. This is your chance to take control of the situation.

Read also:Justin Trudeaus New Girlfriend Everything You Need To Know

What Exactly is EDD Overpayment Forgiveness?

Now, let’s get real for a second. EDD overpayment forgiveness is basically the government saying, “Hey, we know mistakes happen, and we’re willing to cut you some slack.” It’s not a free pass, but it’s a pretty solid deal if you qualify. The EDD might forgive part or all of the overpayment based on certain conditions, and that’s huge news for folks struggling to repay those funds.

Here’s the deal: if the overpayment wasn’t your fault—if it was due to an error on the EDD’s part or something beyond your control—you might be eligible for forgiveness. And even if it was partially your fault, there’s still a chance to get a break. It’s like getting a second chance, and who doesn’t love that?

So, how does it work? The EDD reviews your case, looks at the circumstances, and decides whether to grant forgiveness. It’s not automatic, but it’s definitely worth pursuing. Think of it as a safety net designed to keep people from drowning in debt because of an honest mistake.

Why Does EDD Overpayment Happen?

Let’s talk about the elephant in the room: why does this even happen? Well, sometimes it’s the EDD’s fault—like when they miscalculate your benefits or send you payments you didn’t ask for. Other times, it’s a mix-up on your end, like forgetting to report income or making an honest error on your application. And let’s be real, life happens, and things get messy.

Here’s the kicker: overpayments can happen to anyone, and they’re not always your fault. Maybe you were approved for benefits, but then you landed a job faster than expected. Or maybe the EDD sent you extra payments by mistake. Whatever the reason, it’s important to know that you’re not alone, and there are solutions.

And guess what? The EDD knows that stuff happens, which is why they’ve created the forgiveness program. It’s like they’re saying, “We get it. Let’s work this out together.” So, if you’ve been hit with an overpayment, don’t panic. There’s a path forward, and we’re here to help you find it.

Read also:September 24th Birthday Zodiac Unveiling The Secrets Of Libra

Common Causes of EDD Overpayments

Let’s break it down further. Here are some of the most common reasons why EDD overpayments happen:

- Administrative Errors: The EDD makes mistakes too, and sometimes they send out extra payments by accident.

- Reporting Errors: If you forgot to report income or made a mistake on your application, it could lead to an overpayment.

- Changes in Circumstances: If your employment status changes unexpectedly, it might result in an overpayment.

- Technical Glitches: Let’s face it, technology isn’t perfect, and sometimes systems glitch, leading to incorrect payments.

See? It’s not always your fault. Sometimes, it’s just bad luck or a simple mistake. But the good news is, the EDD is willing to work with you to resolve the issue.

Who Qualifies for EDD Overpayment Forgiveness?

Alright, here’s the million-dollar question: who qualifies for EDD overpayment forgiveness? Well, it depends on a few factors, but generally speaking, if the overpayment wasn’t your fault or if it was due to circumstances beyond your control, you’re in a pretty good position. Let’s break it down:

First off, if the overpayment was caused by an EDD error, you’re almost guaranteed forgiveness. That’s right—no questions asked. But even if it was partially your fault, you might still qualify if you can prove that repaying the overpayment would cause financial hardship.

Here’s the thing: the EDD looks at your circumstances, your income, and your ability to repay. If they determine that forcing you to repay the overpayment would leave you broke, they might forgive it entirely or set up a repayment plan you can actually handle. It’s all about fairness, folks.

Factors That Affect Forgiveness Eligibility

Now, let’s dive into the factors that affect your eligibility for forgiveness:

- fault or no fault: Was the overpayment your fault, or was it caused by the EDD or other external factors?

- Financial Hardship: Can you afford to repay the overpayment without going broke? The EDD takes this into account.

- Cooperation: Have you been cooperative with the EDD throughout the process? That matters too.

- Good Faith: Did you act in good faith, or were you intentionally trying to scam the system? Let’s hope it’s the former.

So, if you’ve been hit with an overpayment, don’t freak out just yet. There’s a good chance you qualify for forgiveness if you can prove that it wasn’t your fault or that repaying it would cause undue hardship.

How to Apply for EDD Overpayment Forgiveness

Okay, let’s get practical. How do you actually apply for EDD overpayment forgiveness? The process isn’t as scary as it sounds, but it does require some effort on your part. Here’s what you need to do:

First, you’ll need to file a request for forgiveness with the EDD. You can do this online or by mail, depending on your preference. Make sure you include all the necessary documentation to support your case, like proof of income, expenses, and any other relevant info.

Next, the EDD will review your request and decide whether to grant forgiveness. This might take a while, so be patient. But trust me, it’s worth the wait. If they approve your request, you’ll either have the overpayment forgiven entirely or set up on a repayment plan that works for you.

Steps to Apply for Forgiveness

Here’s a quick breakdown of the steps to apply for EDD overpayment forgiveness:

- File a Request: Submit your request for forgiveness through the EDD’s website or by mail.

- Gather Documentation: Include all necessary documents to support your case, like proof of income and expenses.

- Be Honest: Be upfront about the circumstances surrounding the overpayment. Honesty is key here.

- Wait for a Decision: The EDD will review your case and let you know their decision. This might take a few weeks, so hang tight.

And that’s it. It’s not rocket science, but it does require some legwork on your part. But trust me, it’s worth it to avoid the stress of trying to repay a big overpayment.

What Happens If Your Request is Denied?

Now, let’s talk about the not-so-fun part: what happens if your request for forgiveness is denied? Well, don’t panic just yet. You’ve still got options. First off, you can appeal the decision. Yep, that’s right—you can fight back if you think the EDD got it wrong.

Here’s how it works: if your request is denied, you’ll receive a notice explaining why. From there, you can file an appeal and provide additional evidence to support your case. It’s like a second chance to make your case, and sometimes, it works.

And even if the appeal doesn’t work out, you might still be able to set up a repayment plan that works for you. The EDD isn’t out to ruin your life—they just want to make sure everyone plays by the rules. So, don’t give up hope if things don’t go your way the first time around.

Tips for Appealing a Denied Request

Here are a few tips for appealing a denied EDD overpayment forgiveness request:

- Gather More Evidence: If your initial request was denied, gather more evidence to support your case. The more proof you have, the better.

- Be Persistent: Sometimes, persistence pays off. Don’t be afraid to follow up and make sure your appeal is being reviewed.

- Seek Legal Help: If all else fails, consider consulting with a lawyer who specializes in unemployment benefits. They might be able to help you navigate the system.

So, even if things don’t go your way the first time, don’t give up. You’ve got options, and there’s always a way forward.

How to Avoid EDD Overpayments in the Future

Alright, let’s talk prevention. How can you avoid EDD overpayments in the first place? Here’s the deal: communication is key. If you’re receiving unemployment benefits, make sure you report any changes in your circumstances right away. That means updating the EDD if you get a job, start earning income, or experience any other changes that might affect your benefits.

And here’s another tip: double-check your application and reports for accuracy. Mistakes happen, but catching them early can save you a lot of hassle down the road. Think of it as a little bit of prevention going a long way.

Oh, and one more thing: if you ever receive a payment you weren’t expecting, don’t spend it right away. Contact the EDD first to make sure it’s legit. Better safe than sorry, right?

Best Practices for Staying in Compliance

Here are some best practices for avoiding EDD overpayments:

- Report Changes Immediately: Keep the EDD informed about any changes in your employment or income.

- Double-Check Your Reports: Take the time to review your reports for accuracy before submitting them.

- Stay Organized: Keep all your documents and communications with the EDD in one place so you can easily reference them if needed.

By following these simple steps, you can reduce your risk of overpayments and save yourself a lot of stress in the long run.

Conclusion: Take Control of Your EDD Overpayment

So, there you have it, folks. EDD overpayment forgiveness isn’t as scary as it sounds. If you’ve been hit with an overpayment, don’t panic. You’ve got options, and the EDD is willing to work with you to resolve the issue. Whether it’s through forgiveness, a repayment plan, or an appeal, there’s a path forward.

Remember, the key is to stay informed, stay organized, and stay proactive. If you think you qualify for forgiveness, don’t hesitate to apply. And if you need help, don’t be afraid to reach out for support. Whether it’s consulting with a lawyer or simply reaching out to the EDD for guidance, there are resources available to help you navigate the process.

And finally, don’t forget to share this article with anyone you know who might be dealing with an EDD overpayment. Knowledge is power, and the more people know about their options, the better off they’ll be. So, go ahead and spread the word. You never know who might need this information.

Call to Action: If you’ve found this article helpful, leave a comment below and let us know. And if you’ve got questions or need further clarification, don’t hesitate to ask. We’re here to help!

Table of Contents

- Edd Overpayment Forgiveness: Your Ultimate Guide to Understanding and Claiming It

- What Exactly is EDD Overpayment Forgiveness?

- Why Does EDD Overpayment Happen?